Other players in the industry have also been examining the application of corresponding formats and concepts for their organization since ING began prominently promoting agile transformation. At the first “Agile Banking” conference in October, more than 15 experts reported on their experiences of agile transformation in the financial services sector. In her presentation “Organizational structures and leadership in transition – agility at any price?”, our colleague Anna-Lena Kuhlmann explored the question of how banks can find the optimal agility mix for them.

For many representatives of the banking industry, agility is no longer just a trend, but an answer to the questions raised by the VUCA world. As complexity and the speed of change increase, banks must also critically scrutinize their business models and adapt their collaboration models. Those responsible hope that agile methods and concepts will lead to less silo thinking, greater customer focus and faster decision-making and implementation.

Fundamental decision on agile transformation

Even if ING’s transformation into an agile organization was not completed “overnight”, it can at least be described as a “big bang in three acts”. In just a few months, the entire institute was “agilized” in a total of three waves – organizationally, procedurally and on a personal level. However, the alternative (and in our experience also the preferred) option for many institutes is to “become more agile”. Agile pilot projects allow the organization to gain initial experience with new methods and formats of collaboration. At the same time, employees and managers have time to grow into their new skills and areas of responsibility. In order to ensure the sustainable success of these agile pilot projects, organizational structures must also be rethought under the “becoming more agile” approach. This is because cross-functional, self-organized teams that develop new things in short cycles do not fit in with typical management careers, annual budget processes or rigid target systems.

Examples of agile organizational models in functional structures

Nevertheless, there are many examples of agile structures within functional structures. One example: so-called deal teams are the flagship of banks, particularly for more complex customer inquiries, for example in wealth management or corporate customer business. In addition to the client advisor, product specialists contribute their expertise to develop holistic solutions in the interests of the client. In addition, an employee from the back office often complements the team to ensure that the solutions developed can also be implemented. This makes a deal team an interdisciplinary team that develops customer-oriented solutions independently, i.e. an “agile team”.

A second example: with the aim of truly optimizing cross-departmental customer processes “end-to-end”, many organizational units must pull together: In addition to the sales units, this often involves the back-office units or sales management. From the units involved, a manager is appointed for each process group who is responsible for further development. Operational work on the processes is carried out by a cross-functional team. The responsible teams are supported by a process organizer. This person is not responsible for the specialist area, but ensures the system-side interface function, for example. Mutual responsibility and cross-divisional process work make it much easier for the divisions to network and develop a uniform understanding of customer orientation.

“One size fits all” does not work

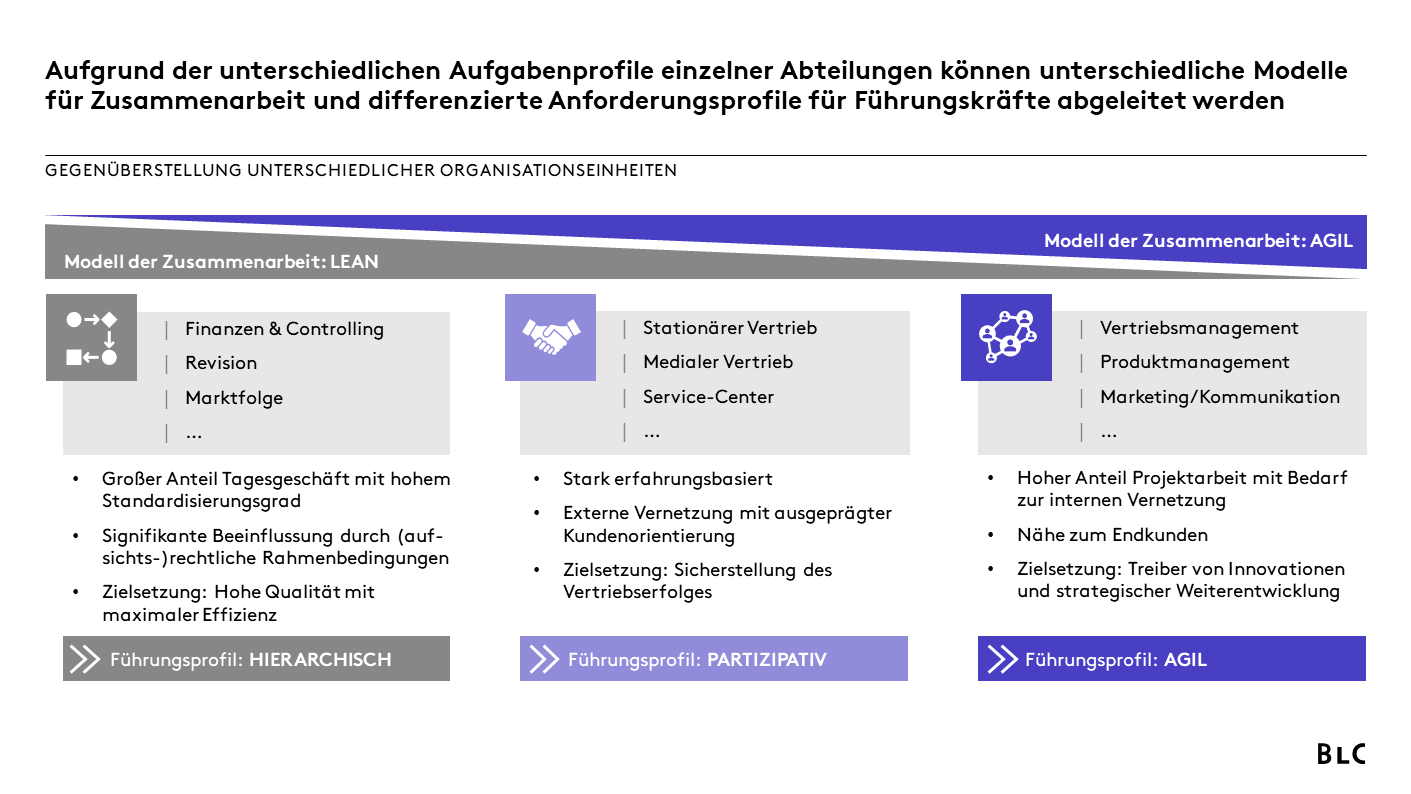

Agile structures are often found in departments that are part of strategic development and are tasked with innovation, for example in sales or product management. Employees in these teams are already frequently involved in project business and are well networked within their own organization. However, there are also other teams within a bank. The task profile of controlling or auditing is dominated by day-to-day business on the one hand and regulated by (supervisory) legal provisions on the other. The objective of these teams is not constant innovation or strategic development, but rather consistently high quality with maximum efficiency. The sales units in turn have a different task profile: Their task is to ensure sales success as the economic basis of the institution. And despite all efforts towards standardization, experience and personal sympathies are still the guarantors of success here.

Due to the heterogeneous task profiles and objectives of the various units in a bank, the “one size fits all” approach seems inappropriate. Agile methods and approaches should only be used where they create real added value. There are certainly use cases for agile formats in both back office and controlling, and agile routines can also promote collaboration in these teams. In principle, however, these teams should be oriented more towards the methods of lean management in order to fulfill their basic objective. The structural and process organization should reflect this accordingly. On the other hand, the organizational and operational structures of teams in which agile methods can be used in a multi-value way due to the task profile should be adapted. The following diagram illustrates these relationships.

Differentiated leadership roles are necessary

With different models of collaboration, the role of the manager must also be considered in a differentiated manner and shaped depending on the model chosen. While the hierarchical manager leads the team as an expert with clear guidelines and independent decisions, the agile manager empowers their team to develop solutions and make decisions independently. It is therefore more the responsibility of the agile manager to create transparency regarding strategic framework conditions and guidelines that the team can use as a guide.

Interlinked employee and management development as a success factor

Great attention should therefore be paid to management development when implementing agile structures. Due to the clear functional structures in a bank, hierarchical managers are typically promoted and required. In agile organizational models, however, a different management style is required. At the same time, this also implies a mandate for HR development – because employees in agile teams also work with new models of collaboration and need to contribute different skills. In order for the transformation to succeed, employee and management development must therefore be dovetailed and in line with the desired target image for collaboration.